Great news! We now have 585 2022 SENP members as of 2/28/22, only 17 fewer members than in 2021. Once again, we want to say a huge thank you to all the street coordinators and Leads in Schreiber Manor and Forestcrest for their help during our enrollment. We couldn’t do it without them, or you, our members, so thank you, as well, for your continued support of this neighborhood patrol.

| 1 | 2 | 3 | 4 | Total | ||

| Count of Members | 191 | 106 | 209 | 79 | 585 |

Now that we know how many members we have for 2022 and adding that to the surplus of funds we had from 2021, we will be able to afford 67 hours per week of patrol. That said, we have one officer on paternity leave who will return at the end of March so we won’t be able to realize the 67 hours of patrol until he returns. Our Friday patrol officer, who has been on light duty due to an injury, will return to patrol on Friday, March 4. We’d also like to welcome Officer Brad Smith, who will patrol Sundays starting March 6.

At some future point in time, we hope to be able to add an additional 8 hours of patrol for two overnight shifts when another officer who is on temporary leave returns. We will inform our members when we’re close to or at that level of patrol and we will update you on the total hours of patrol.

Apologies to anyone who had requested out of town home service while the officers have been out on leave. As of this past weekend our Saturday patrols resumed, and as stated earlier the Friday patrols will resume March 4. If you request OOT home check in the future, and you don’t receive a text back saying an officer has received your OOT home check request, please email to let us know so that we can address any issues with our DPD ENP coordinator. Thank you for your help.

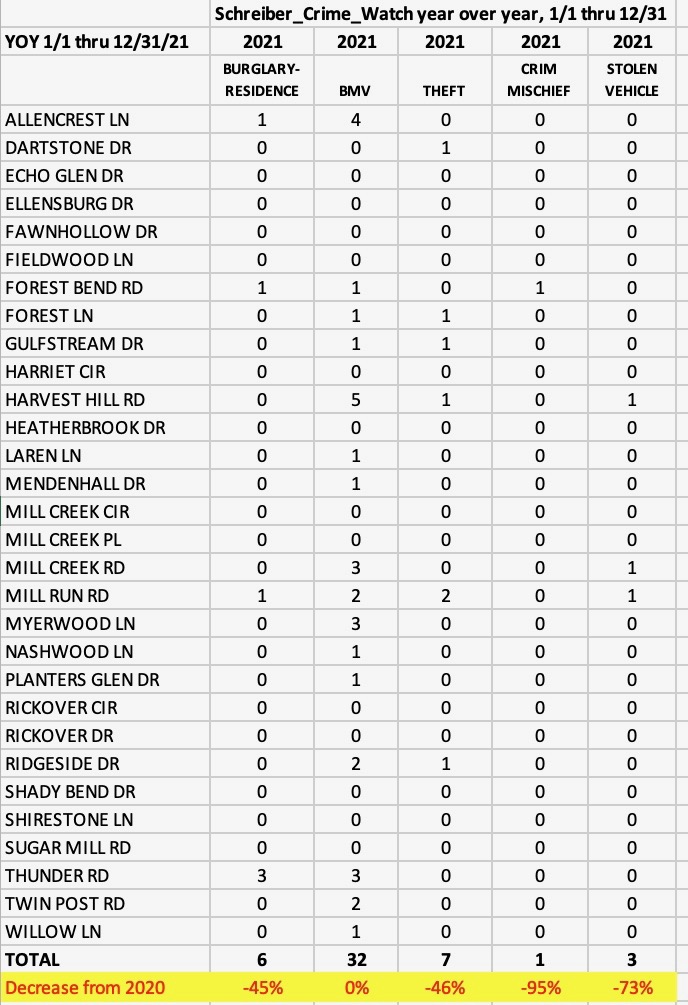

February 2022 Crime Report from Schreiber Crime Watch

Feb 26

4939 FOREST (between Nanwood and Nashwood) – robbery of individual – suspect used force to maintain control of stolen property

11920 INWOOD – theft – property taken out of truck bed – parking lot of Lowe’s

February 19

No crimes reported

February 12

No crimes reported

February 5

4939 HARVEST HILL – between Drexelwood and Inwood – theft of property – trailer

4311 Dartstone (off of Crestline and south of Forest Bend) – theft – vehicle part

Call 911 Reminder: If you see a crime in progress, call 911 first, then the SENP patrol cell, (469) 346-0827.

Help Avoid Crime Reminder: To help deter criminals, lock your gates and turn on and keep your lights on at night.

Have a great week.